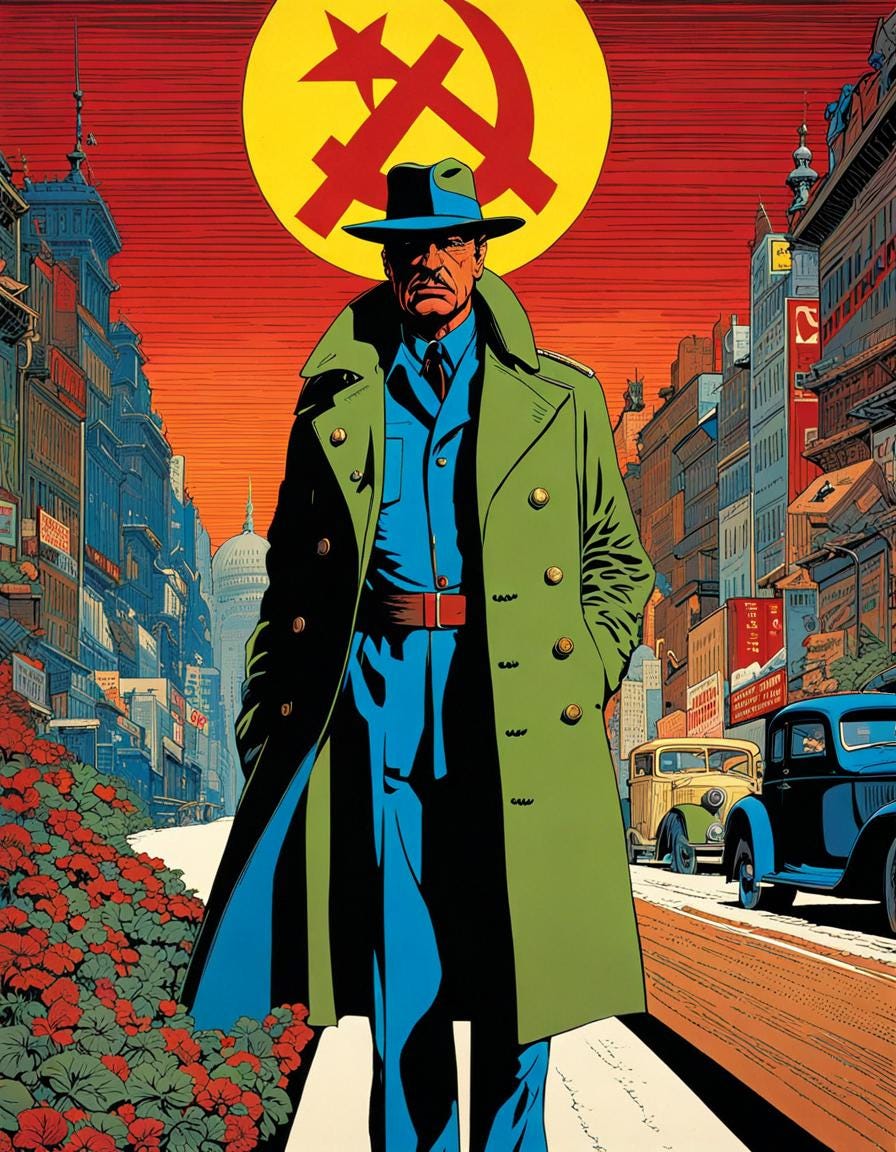

Our last slice of Radio Free Pizza detailed (in part) the catastrophic failure of mRNA injections deployed in response to the 2020–’23 coronavirus pandemic, but we got through it without mentioning one of the U.S. pandemic response’s most visible mainstream dissidents: Robert F. Kennedy Jr., whom I maintained at the start of this year would make a fine Antichrist, if I were in charge of casting.

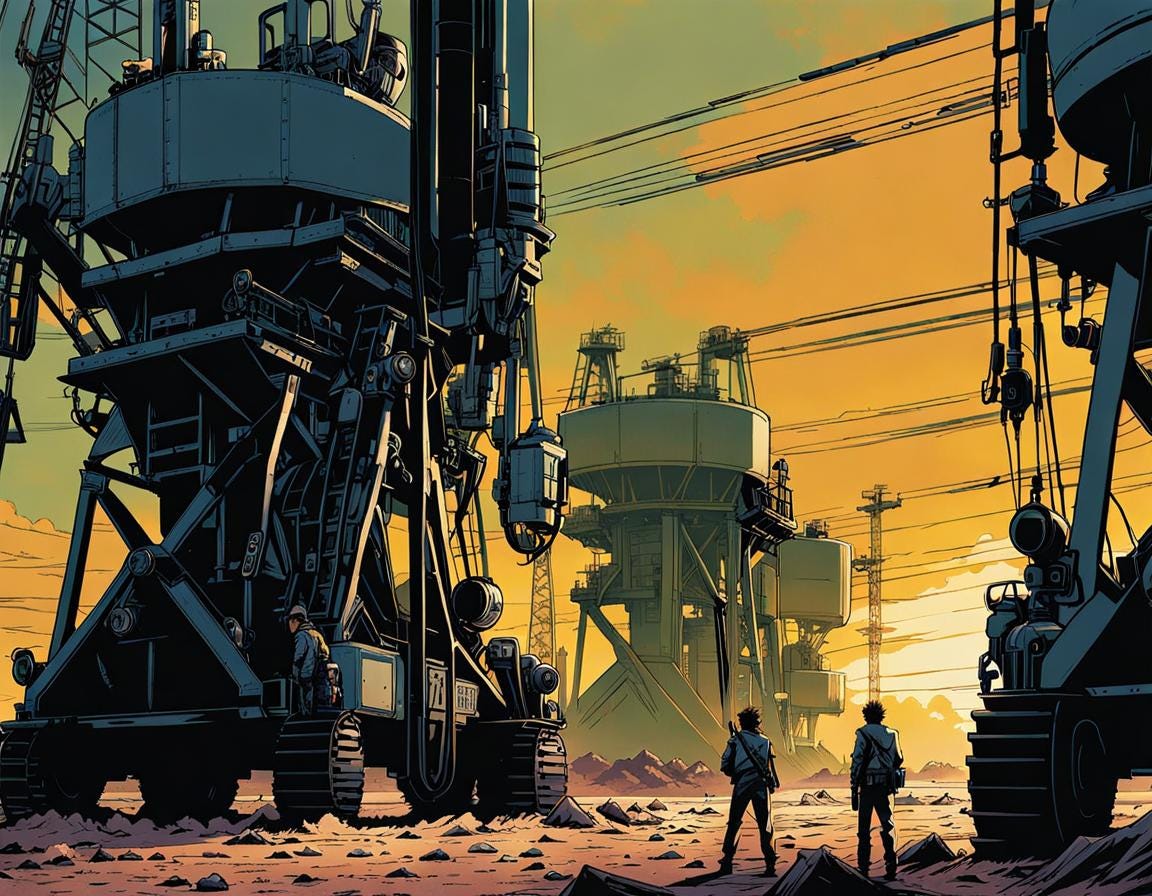

Similar to my coverage of Dr. Robert Epstein’s work exposing Big Tech’s influence on elections, mentioning Kennedy now means broaching a subject I’ve meant to cover for a while—but (perhaps surprisingly) not because of his public health positions. In fact, my interest in covering this scion of the Cold War’s Camelot dates to last October, when I first wrote about the intersection of energy markets and geopolitics in reference to what we’ll now call the BRICS+ trading bloc.

Of course, Kennedy has something (false) to say about energy policies and geopolitics. Before his resurgence to public prominence during the coronavirus pandemic, the son of Senator Robert F. Kennedy and nephew of President John F. Kennedy had been known for decades as an attorney renowned for his extensive work in environmental law. Over the course of his career, he has been a key figure in legal battles against environmental pollution, advocating for clean water, air, and the overall well-being of the planet. Beyond his legal endeavors, Kennedy has authored books on environmental issues, adding his voice to the discourse on sustainability and the protection of natural resources.

The candidate’s 2007 article on domestic energy policy advocates for a transformative shift in the energy landscape to combat climate change and reduce dependence on fossil fuels. In it, Kennedy argues that the free market can be a powerful force for combating global warming, if allowed to function without the distortions caused by government subsidies and hidden costs. He highlights the success that major corporations like DuPont and Wal-Mart reportedly met upon embracing environmentally friendly practices—not for altruistic reasons, but because of the economic benefits they provide.

Kennedy identifies market failure as the root cause of the global climate crisis, emphasizing that the true cost of fossil fuel usage is not adequately reflected in the market. He contends that direct federal subsidies to the oil industry, amounting to billions of dollars annually, distort the market by artificially lowering the price of gasoline and hindering the competitiveness of alternative fuels. Moreover, he asserts that hidden subsidies, such as the environmental and health damages caused by oil pollution, are not factored into the cost equation. As an alternative, Kennedy instead proposes six mechanisms to foster a free-market approach:

Feebates: Imposing fees on inefficient vehicles and rebating that money to consumers who choose more efficient cars.

Cap and Trade: Implementing mandatory limits on carbon emissions, creating a market for products and technologies that reduce energy consumption.

Clean Incentives: Using revenues from carbon credits to incentivize the development and adoption of new technologies.

Decoupling: Detaching utility profits from energy sales, creating a market that rewards efficiency.

Net Metering: Allowing homeowners with solar panels or wind turbines to sell excess electricity back to the grid.

Performance Standards: Establishing minimum standards for energy efficiency in appliances, cars, trucks, and buildings.

Kennedy concludes that by creating a rational marketplace that rewards environmentally responsible practices by implementing his policy recommendations, the United States can lead the way in addressing climate change while simultaneously fostering technological innovation, economic prosperity, and energy independence.

Maybe it’s comforting to know that some things never change: the candidate’s own writing from 2007 largely mirrors his rhetoric in 2023. As Fox Green noted in April of last year for Space Commune, his then-Democratic presidential campaign adds another detail to its environmental platform about “‘shift[ing] agricultural subsidies to encourage regenerative practices,’” from which Green concludes:

Either Mr. Kennedy has not been reading the news about Sri Lanka, or he’s aware of the effect of Shiva’s organic, anti-science, low yield agricultural methods and is supporting those methods purposefully for their low yield results.

Now, whether Kennedy’s ill-informed or malicious, the agricultural policies that Green calls “eco-Malthusian” still rely on the same supposedly free-market solution of incentivizing industry through changes to government subsidies.

What seems to have changed, however, is Kennedy’s newfound belief that “climate change is being used to control us through fear” while still asserting that free markets offer the better approach on combatting pollution. Though he continues professing the reality of climate change and its impacts, Kennedy criticized the handling of the situation by intelligence agencies and the “billionaires boys’ club at Davos” in the World Economic Forum (WEF), whom he argued use environmental concerns as a pretext to impose totalitarian controls—similar to the approach taken during the coronavirus pandemic. Advocating once again for addressing climate issues through free-market policies, Kennedy also implored us to avoid fear as it can be manipulated as a tool by those seeking greater power and control.

However, Kennedy observes this quest for greater control not just among international public/private partnerships pretending they’re interested in preserving our planet’s ecosystem. His aforementioned false claims to Dave Rubin last year on the geopolitics of energy production show that he’s not just concerned with how U.S. federal subsidies allow Big Oil to pass the cost of environmental destruction on to consumers, or with how global-governance initiatives will impose authoritarian restrictions on those same consumers. Though Kennedy maintains (at ~40:59) that Americans “need to unravel the empire,” and advocates for eliminating the covert USAID and NED operations used to effect regime change in foreign governments, the geopolitical importance he ascribes to Israel (at ~42:25–44:08) reveal other concerns:

Israel is […] a bulwark for [the U.S.] in the Middle East […] If you look at what’s going on in the Middle East now, the closest allies to Iran are Russia and China. Iran also controls all of Venezuela’s oil […] Hezbollah is in Venezuela: they have propped up the Maduro regime, so they control that oil supply. Saudi Arabia is now joining BRICS, so those countries will control 90% of the oil in the world […] If Israel disappeared, Russia and China would be controlling the Middle East.

Now, Kennedy may have cause for concern here, in the broad strokes: as journalist Pepe Escobar observed in January, Saudi Arabia issued $12 billion in bonds to maintain their national income during a period of voluntary OPEC+ production cuts that began at the end of last November and which the bloc decided today to extend—allowing the kingdom to continue selling cheap oil to their Asian trading partners, and thereby cutting U.S. oil exports out of Asian markets. With these bonds denominated in U.S. dollars, the threat to the petrodollar system doesn’t seem immediate; however, Saudi Arabia continues negotiating with China to sell its oil for yuan, and even if it took in no more dollars at all, the kingdom could thereafter pay holders of its newly issued bonds (at least in the short-term) with the yield it takes in from more than $100 billion in U.S. Treasuries.

So, yes, Kennedy’s clever enough to read the writing on the wall. Still, his comments came at the beginning of November, before OPEC+ announced its production cuts. More importantly, he got the facts wrong: in fact, BRICS+ controls less than a third of the world’s oil production. (Reuters estimated it at 41% last September, based on OPEC data, but since I took the time to calculate it myself, I’m going with <1/3.) With Venezuela producing 76,000 barrels per day in 2022 and Hezbollah’s Lebanon producing less than 1,000, together they could only contribute to BRICS+—to which neither country belongs—less than 1% of the 93.9 million bpd produced that year.

Of course, maybe when Kennedy said “oil supply,” he didn’t mean production, but proven reserves. In that case, OPEC controls about 80%, not BRICS+: only Iran, Saudi Arabia, and the United Arab Emirates currently belong to both. Accordingly, his exaggerations about BRICS+ at least demonstrate a journeyman’s understanding of the importance of oil supply to the global economy and, therefore, to geopolitics.

But on top of that concession, I have to give Kennedy some credit: indeed, Israel serves the purposes of the same U.S. imperialism that he supposedly wants to unravel. I doubt many subscribers would disagree with me there, but in case anyone wants a little more detail, I recommend the appearance of Joti Brar, from the Communist Party of Great Britain (Marxist-Leninist), in an interview with Garland Nixon last December—“Imperialism: Parasitic, Decadent, and Doomed” (love that title)—where she offers (at ~28:45–34:24) an insightful overview on the founding of modern Israel, its relationship to the Western imperialist strategy to dominate energy markets, and how it produced the Israeli state’s genocidal campaign in Gaza.

It’s not actually about Palestine: it’s about […] domination of […] the oil of the Middle East. Now, if you look back to when the Zionist colonization […] was first tentatively green-lighted […] in 1917 […] at that time, oil had just become number-one commodity on the planet. Why? Because not only was it beginning to drive industry […] in 1912 […] Britain’s Royal Navy […] switched to oil power. So oil became the number-one commodity of the world, and it has remained so […] And something you have to understand about imperialism is, it not only needs resources […] it also needs to monopolize resources to deprive its rivals of them […] monopolizing control of very key important raw materials is the key to the continued existence of monopoly powers. So when you look at the Middle East […] you have to understand it in this context of the battle to keep control of the Middle Eastern resources […] the origins of the Palestinian conflict come from this decision that the best way to keep control of the Middle Eastern resources was to have a settler colony in the middle of the region.

As Brar explains, the conflict in Palestine and Israel stems first and foremost from the demand to maintain strategic control of Middle Eastern oil. (With regard to Palestine, we might add to that its natural gas.) The roots of the Zionist colonization trace back to the early 20th century when oil became the world’s number-one commodity, and imperial powers sought to monopolize key resources—not only for their own use but also to limit their rivals’ access. For that reason, Brar contends that Israel functions as an outpost for Western imperialism, and serves a broader strategy to maintain control over Middle Eastern resources:

Eventually […] Lord Balfour, Prime Minister […] signed a piece of paper at the same time that the British government—in the deal of getting the Arabs to fight on the British side against the Ottoman Empire and World War I—had promised the Arabs liberation after World War I (which they didn’t get) [and] he simultaneously signed a piece of paper to the Zionists, saying, “We think it’s a good idea to set up a settler colony, a homeland for the Jewish people in Palestine.” And that is how you have to understand Israel: Israel is not about protecting Jews. It didn’t happen as a response to the Holocaust […] It was accelerated through that process […] if you want to understand what's going on in Palestine, you have to understand […] In return for getting sort of huge amount of backing […] the Jewish people who colonized Palestine and set up the state of Israel agreed that they would be imperialism’s outpost […] Essentially it serves the oil monopolies. And the main governments of the oil monopolies are the American government and the British government […] the U.S. government and the British government are the main representatives of Big Oil. We are the basis for the biggest oil companies in the world. And they are some of the most important monopolies in the world, full-stop, right? And what they want very much dictates the policies of the British and American (U.S.) governments.

I’m sure few would disagree with Brar that the U.S.’s and the UK’s interests in the Middle East focus on the region’s oil, assuming we all remember the invasion of Iraq in 2003: after all, the U.S.’s then-Vice President received almost $2 million between 2000–’03 from Halliburton, the oil company at which he sat as CEO immediately before returning to politics in 1999—and in which the then-VP bought stock options in the same period before the company took in $2.1 billion (38% of its revenue) from U.S. military-contracts in just the first quarter of 2004, one year after the invasion.

So, whatever someone thinks of it, hardly anyone disputes it. What’s interesting, though, is that Kennedy and Brar can have polar-opposite moral responses to the historical decisions that deployed the State of Israel as a geopolitical tactic to establish an imperialist outpost—but in the end, both seem to say more or less flatly that, in fact, it’s about the oil.

While I recommend the whole of Brar’s interview, she offers us nothing like Kennedy’s capitalist prescription for how the U.S. or any country might change its domestic energy policies to address ecological destruction. However, she does provide (at ~58:46–1:00:48) an explanation for why Kennedy’s plan could never address imperialism’s prerogative to dominate energy markets geopolitically:

Officially all the imperialist governments have policies against cartels and monopolization. But the truth, we know that it continues just as it did before World War I […] when these companies would get together to form a cartel, they’d have a contract drawn up […] the terms of the contract were public […] you could go and have a look at […] how they divided up the market between themselves, and what they agreed about production quotas, and what they agreed about price fixing. Now, officially, we don’t do that stuff anymore, right? But in reality, we all know it’s still going on. The price fixing is one of the ways that the monopoly corporations keep their profits higher than they otherwise would be: is by agreeing on market shares with each other and agreeing on price fixing with each other, right? But […] inside the cartel, there’s still competition. There's still the desire of each member of the cartel to out-compete the other members. And eventually, none of these cartel agreements actually last very long […] it always breaks into open competition. The desperate quest for bigger and bigger a share—for a bigger share than someone else, to expand your share of markets or resources, to monopolize and loot—is just too strong. And in the end, it breaks down all these alliances. And that’s why […] the capitalists […] need that state and that army behind them when they go to war.

As Brar tells us, private transnational corporations today band together as informal cartels, secretly fixing prices, but when competition between them breaks out, they still rely on the military force of their nation-states to secure markets and resources. Accordingly, it’s hard to see how Kennedy’s proposal for a free-market energy policy might ensure that multinational corporations with American headquarters play nicely. Maybe he hasn’t really thought about: after all, he doesn’t seem to see the contradiction between calling to “unravel the empire” and praising Israel or any country as “a bulwark for us.” (More important, you see, than Brar’s mere “outpost.”)

But what’s the alternative?

Instead of following Kennedy’s advice and letting the markets decide, let’s say that the U.S. nationalized its oil production: let’s say the federal government withdrew all its subsidies from the oil industry (or found the money in some other fashion) and bought some fields on the Permian basin—or in North Dakota maybe, whichever—where it established a national oil company (NOC) and called it “AmericaNOC.”

Obviously, AmericaNOC would have profound implications for the economy, politics, and the energy industry. From a market perspective—assuming, of course, that the U.S. government doesn’t simply expropriate its competitors’ holdings—AmericaNOC’s entry would disrupt the informal cartel of the Big Oil oligopoly, in which a small number of massive firms (ExxonMobil, Chevron, Shell, etc.) dominate the industry, each controlling significant portions of the market and exercising substantial influence over prices and output.

Launching AmericaNOC would reshape the competitive dynamics in upstream sector, encompassing exploration and production, where microeconomic principles like supply and demand dynamics significantly influence decision-making. But whereas exploration and production companies respond to fluctuations in oil prices, and adjust their drilling activities and exploration efforts based on profitability considerations, AmericaNOC could focus instead of meeting domestic market demand, whereas Big Oil could take advantage (for example) of Kennedy cap-and-trade and clean-incentives proposals. While introducing further competition in these upstream oil markets, AmericaNOC would simultaneously profit from its sales to the downstream sector for refining and distribution.

Employment patterns in the upstream sector would likely undergo changes, with job opportunities increasing within AmericaNOC while potentially affecting existing private companies. In the event of widespread unemployment, such as when the U-3 unemployment rate hit 10% in October 2009, initiatives from AmericaNOC could offer some relief as a kind of modern-day Civilian Conservation Corps.

Just to give AmericaNOC a little more “home of the brave” flavor, suppose that the U.S. organized it in a manner similar to that of Saudi Aramco, the national oil company of Saudi Arabia, after it went public with an initial public offering (IPO) in 2019—while still, of course, retaining majority control. Of course, Saudi Aramco is an unusual case: NOCs aren’t typically structured as publicly traded joint-stock companies, due to the strategic importance governments often attach to the control of their oil and gas resources. But like Saudi Arabia, the U.S. enjoys vast proven reserves—267.19 billion barrels in 2022 for the former, compared to the U.S.’s 55.25 billion barrels—and while Saudi Arabia might have five times the proven reserves, the U.S. still produces the most.

Incorporating AmericaNOC as a joint-stock company with majority-state-ownership allows us the chance to incorporate features from the example another BRICS+ member: Gazprom, of the Russian Federation. The state enterprise has historically distributed dividends to its shareholders, including to the Russian government. Russian citizens, as taxpayers and indirectly through government ownership, have a stake in these dividends. Of course, the distribution of dividends can be subject to changes in government policies and corporate decisions, made according to the demands of market conditions and the like—but I don’t think any U.S. citizens would turn down a dividend payment courtesy of AmericaNOC.

Though establishing AmericaNOC would certainly raise concerns about interference in the free market, the move would ensure that the country maintains a strategic grip on national energy resources—meaning that the past two years of drama surrounding the Strategic Petroleum Reserve need never repeat. In fact, managing the country’s oil reserves strategically would stand as one AmericaNOC’s key functions, through its influence on extraction rates, on international collaborations (maybe even in the cartel of OPEC+! Since we’re speaking hypothetically), and on long-term resource planning.

Surely the launch of AmericaNOC would have substantial political ramifications, as it inherently involves political decision-making influenced by geopolitical considerations, domestic energy policies, and broader political climates. AmericaNOC’s activities would be subject to political scrutiny. Undoubtedly its operations would face scrutiny regarding environmental practices, sustainability, emissions reduction, and social responsibility. But with a focus on national interests, AmericaNOC could also promote technological developments in the energy industry to accomplish the same objectives as the “clean incentives” of Kennedy’s 2007 plan—but without the carbon credits. In fact, AmericaNOC could help develop technologies to improve the efficiency of and reduce the pollution from the midstream and downstream sectors too, with the midstream sector’s infrastructure among the potential areas of focus for AmericaNOC’s shared ventures. Such investments would allow AmericaNOC to better adjust its upstream operations in response to changes in price transmission mechanisms according to midstream capacity and downstream maintenance, among other needs.

Even if the U.S. doesn’t take the opportunity (present in our hypothetical above) to join OPEC+, AmericaNOC’s operations would have implications for U.S. international relations with other oil-producing nations, affecting trade dynamics and partnerships in the energy sector. Such partnerships, along with other external factors like geopolitical events and technological advancements, can also positively influence the microeconomic landscape of the U.S. oil markets. Shifting our model from OPEC+ to BRICS+, international cooperation between NOCs belonging to the trade bloc could help the U.S. and other member nations avoid any crisis like that resulting from the ’70s oil embargo that OPEC launched in retaliation against the country’s support for Israel. Of course, it will depend primarily on market conditions whether membership in such cartels or trade blocs confers the hypothesized benefits; nonetheless, the potential benefits of such cooperation shouldn’t be underestimated.

Hard to predict, of course, how ExxonMobil or any other member of the informal Big Oil cartel might welcome AmericaNOC. They should welcome competition, right? But I think it’s easier to predict how Kennedy would react: even if AmericaNOC paid for its fields using the savings from eliminating Big Oil subsidies, its operations would slow the ongoing concentration of wealth under monopoly capitalism into the hands of the so-called elite. The dynastic heir might argue that establishing AmericaNOC would offer no benefit in terms of environmental gains, but I would remind him then that the proposal begins with his—to remove Big Oil’s direct federal subsidies—and also allows for the U.S. to implement his six proposed market mechanisms as complementary initiatives to improve efficiency and reduce pollution. But I think he’d find another excuse: though I’m sure Kennedy styles himself an ally of the American working class—enough that he wouldn’t speak out explicitly against any plan that promised to pay citizens an occasional dividend—I believe that his unwavering support for a bastion of the empire he claims to wish to dismantle gives us good reason to question how sincerely he’d represent that working class.

Despite the potential objections from Kennedy and his ilk for the challenge that our joint-stock-state-enterprise alternative would pose to the free market—or, more accurately, to the ability of multinational cartels to corner it—AmericaNOC could reshape the competitive dynamics in the oil sector, influencing employment patterns and introducing novel political considerations in both the domestic and international spheres, while also enriching its citizens through the trade of their nation’s energy wealth. Sure, we know that our capitalist republic’s ruling class wouldn’t like the idea: but, maybe that’s the best reason to give it a shot!