Historians remember Ancient Rome (753 BC – 476 AD) as a cornerstone in the historical development of political philosophy and governance models throughout Western civilization. The city’s historic periods of monarchy, republic, and imperial rule provided a diverse array of political systems that have profoundly influenced modern governance. The Roman Republic, in particular, introduced concepts of checks and balances, separation of powers, and civic duty, which have become foundational principles in contemporary democratic societies, while the rich political discourse of Roman philosophers and statesmen continues to inform and inspire political thought and practice today.

Accordingly, Ancient Rome piques the interest of a station like Radio Free Pizza, where we purport ourselves to excavate “deep trends” in politics and other fields—combing their hidden layers to get a better sense of where we’re headed next. To that end, we could hardly ask for a better vein to mine: the history of this ancient civilization, with a narrative rich in ambition, intrigue, and dramatic shifts in governance, still echoes in the corridors of power today.

Of course, some would say we’re a year late, given 2023’s social media trend of TikTok videos showing men describing their fascination with the grandeur of the Roman Empire, its engineering marvels, and its influential political system. At the time, some historians suggest this interest is partly due to the overemphasis on Ancient Rome’s masculine-associated aspects, like military and political history, in Western culture. Other commentators doubled down on that thesis, describing a “masculinity polycrisis”—the compounded crises facing men today, who are struggling with a sense of lost status—leading men to gravitate toward figures like Andrew Tate and Jordan Peterson, to increasingly adopt the stoicism of Marcus Aurelius’ Meditations, and to seek solace in the structured legacy of Ancient Rome. They argue that the Roman era, with its clear patriarchy and status hierarchies, offers a nostalgic contrast to contemporary uncertainties, and that men’s preoccupation with the Roman Empire reflects a deeper search for personal purpose and civic stability amid contemporary economic and social upheaval.

That last part sounds a little closer to the truth, I think, than any crisis of masculinity. After all, some six years ago, 40% of Americans agreed either, “When it comes to our political and social institutions, I cannot help thinking, ‘Just let them all burn,’” or, “We cannot fix the problems in our social institutions, we need to tear them down and start over”—and, speaking as a current U.S. resident, I can only imagine that proportion has since risen.

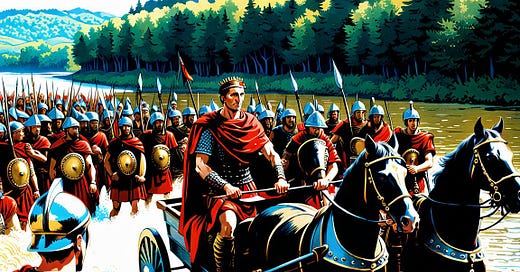

Maybe some of those Americans (the men among them fixated on Ancient Rome, anyway) would even say that their country is headed for a turning point as pivotal as Gaius Julius Caesar’s decision in 49 BC to defy the orders of the Roman Senate and cross the Rubicon River with his army, effectively declaring war on the Roman Republic and leading after his assassination to the rise of the Roman Empire.

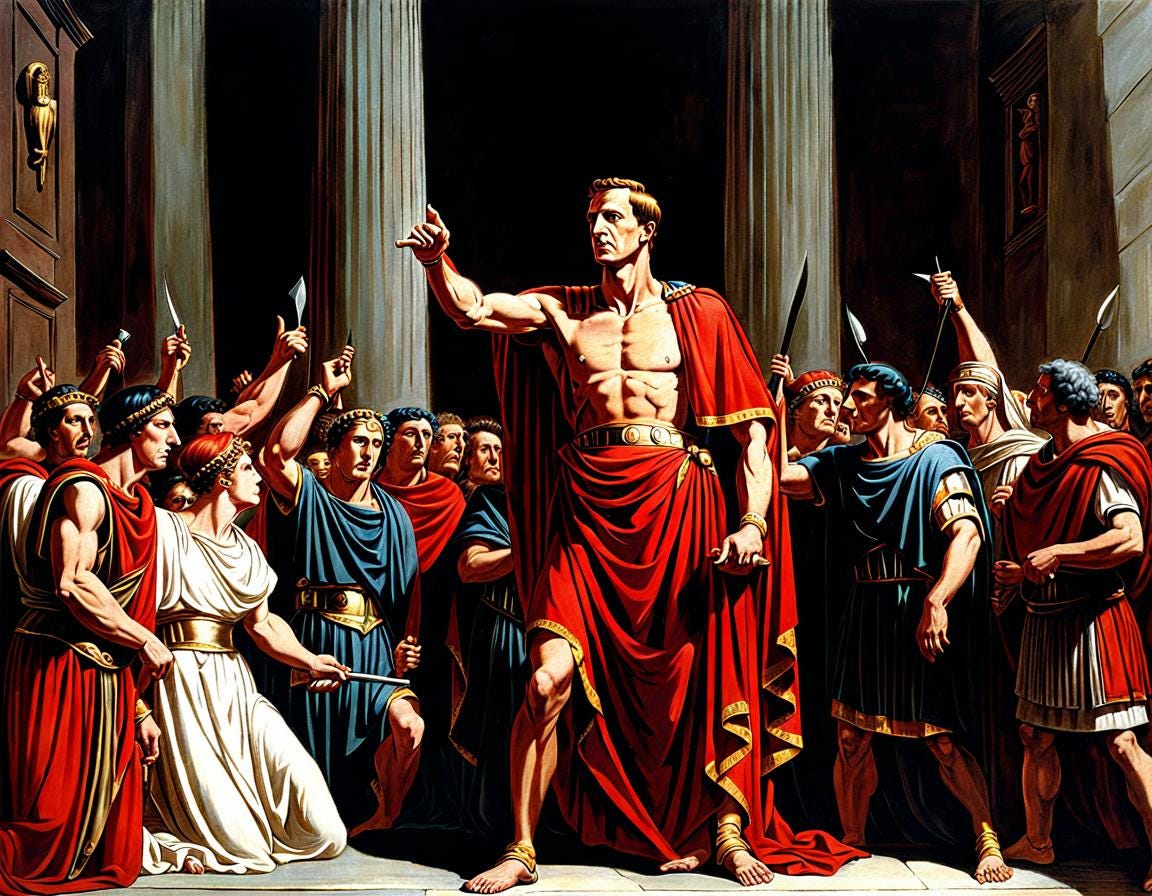

Here at Radio Free Pizza, Caesar’s assassination on 15 March 44 BC has some particular interest for us as a testament to the monumental impact of a historical conspiracy. Longtime readers will surely recall that we delve now and then into the field of conspiracy theories, and you could hardly ask for one with more significant consequences than that coordinated to eliminate Ancient Rome’s dictator perpetuo.

The conspirators, numbering between 60 and 80 (included many of Caesar’s closest allies and former enemies he had pardoned) meticulously planned their attack to occur during a Senate session, where Caesar would be most vulnerable. As Caesar took his seat, the conspirators surrounded him under the guise of presenting a petition before Publius Servilius Casca struck the first blow, followed by a flurry of stabbings from the others. This pivotal moment not only altered the course of Roman history but also serves as a powerful reminder that conspiracies are not merely the stuff of fiction or modern speculation: they have, in fact, played crucial roles in shaping the world as we know it, and Caesar’s fate continues to inform our modern understanding of power and conspiracy.

Just ask Martin Armstrong. The economic forecaster writes of Caesar reverently, describing how the Roman aligned early in his career with the Populares Party, opposing the senatorial nobility, prefiguring the significant reforms he would implement decades later as dictator. Despite efforts to portray him as a tyrant, Armstrong argues that Caesar aimed to reform the corrupt Senate and to improve Roman society—in addition to addressing the debt crisis (following the fire of 50 BC, an earthquake in 49 BC, and a resulting housing shortage, during which debt pervaded all social classes) that Armstrong cites as the fuse for the civil war. As he tells us, Caesar’s response was unprecedented: he forgave all interest and required prior interest payments to be applied towards the principal loan, and appointed assessors to revalue properties to their original loan values, preventing lenders from demanding repayment based on inflated current values after asset prices fell.

Armstrong’s “Anatomy of a Debt Crisis” (2012) provides further details, highlighting Caesar’s comprehension of and his effective steps to address Ancient Rome’s debt crisis through innovative solutions. Here, Armstrong explains that the Caesar’s political opponents, the Optimates, obstructed political reforms and contributed to the Republic’s decline into oligarchy, which they incited a civil war to maintain. In contrast, Armstrong emphasizes Caesar’s genuine efforts for the people and, as a senator, his rejection of debt cancellation for the elite despite the potential for personal gain. As a dictator, his swift and extensive domestic reforms—such as the introduction of the Julian calendar, labor laws, educational and medical initiatives, and welfare system overhaul—demonstrate his commitment to genuine reform. Discussing Caesar’s response to a significant debt crisis and real estate collapse in Ancient Rome, the forecaster describes how Caesar didn’t cancel debts or redistribute wealth, but instead revalued property to pre-crisis levels and credited interest payments towards the principal (as described above), leading creditors to lose about a fourth of their loans. This balanced approach, Armstrong argues, helped preserve economic stability.

For those interested in learning how Armstrong compares the debt crisis of the Roman Republic to the financial conditions of 2024—including the currency monetary system and debt levels, given the potential for governments to default, as well as Central Bank Digital Currencies that would lead to tyranny and loss of freedom—you can turn to his appearance last month on Ben Mumme’s Living Your Greatness.

Here, Armstrong argues (at ~20:36–21:59) that Ancient Rome’s success and stability stemmed from its policy of allowing conquered peoples to maintain their own religions and customs, and credits its economic policies—enabling trade across its territories without taxes on imports—for contributing to a long period of peace and prosperity. Accordingly, Ancient Rome demonstrates for Armstrong that, “When we all get together, we all benefit.”

On the other hand, of course, Ancient Rome seems to represent Armstrong’s premier example for arguing (at ~34:43–35:17) that,

Republics are the most corrupt form of government. Unfortunately, the fake news back in ancient times was Cicero. A lot of the Founding Fathers of America, they read, “Caesar was this dictator,” etc. […] When Caesar crossed the Rubicon, he didn’t fight his way to Rome. All the cities cheered. They opened their gates. Why? Because there was a debt crisis back then as well. And the Senate fled to Asia. There was no battle. […] Why did they flee? Because the people hated them. They were corrupt as hell. To illustrate the level of corruption, it [took] Julius Caesar to revise the calendar […] Why? Because Rome used basically the calendar on the moon, but […] they had to insert some days like leap year to adjust it to the sun. Who was in charge of it? The high priest on a discretionary basis. So they would just simply go to the high priest and say, “Look, you know, here’s a couple million bucks or whatever. Insert a few couple months so that we don’t have to go to lecture right now.” […] So when Caesar crossed the Rubicon, it was January 10th. It should have been winter, but it was summer. So when he got in, he cleaned up the corruption […] Eventually, that’s why they assassinated him, just like they just tried on Trump. They don’t want change. […] [Caesar] pardoned everybody who was against them. Is that a dictator? He was very magnanimous, and they came back and killed him because it was all about power […] Then you end up with the imperial period, with Augustus becoming the first emperor. Why? Because the Senate was so corrupt, and nobody wanted to give them power again. It was better to be in the hands of one guy than it was in the Senate. So, I mean, we have to look at these things. I mean, every representative we have in a parliament or Congress, they’re up for sale: “Vote my way, what do you want?”

Interestingly, Armstrong’s reference here to the recent assassination attempt on former President Trump finds an echo in Constantin von Hoffmeister’s staging of Trump as the resurrection of Caesar in the wake of the former president’s assassination attempt to promote his book Esoteric Trumpism. That work presumably expands on the ideas Hoffmeister introduced last month on the U.S.’s Independence Day in his “Trump: The New Caesar of the West” published in Eurosiberia: here, Hoffmeister interprets Trump’s potential return to the presidency through Oswald Spengler’s theory of historical cycles, arguing that the former president’s policies on immigration, judicial reform, and economic nationalism reflect a Spenglerian shift from democratic institutions to charismatic rule in response to societal fragmentation, the perceived threat to the U.S.’s cultural essence and sovereignty, and civilizational decline.

To me, it seems likely that Armstrong would agree with Hoffmeister’s reading of Trump as a social and cultural reaction to national decline, knowing how his own economic models have long been tracking the same. But I suspect it would surprise the paleoconservative economist to learn that his generous assessment of Caesar as a reformer rather than a dictator is one that some Marxists hold in common: among them, Michael Parenti, whose The Assassination of Julius Caesar: A People’s History of Ancient Rome (2003) received a deep analysis from Keegan Kjeldsen (previously featured here in March) on The Nietzsche Podcast last year.

In The Assassination of Julius Caesar, Parenti presents the counter-narrative to the traditional portrayal of Caesar as a tyrant, arguing instead that Caesar was a reformer who aimed to address the inequality and exploitation prevalent in the Roman Republic, challenging the entrenched power of the patrician oligarchy. As Kjeldsen tells us, Parenti provides historical context on the disintegrative phase—as Peter Turchin would put it— of the late Roman Republic, which we learn (at ~17:46–19:12) was characterized by oligarchic wealth accumulation, land grabbing, and the marginalization of the plebeian class.

Kjeldsen returns later (at ~42:34–43:56) to the topic of landholding concentrations among the patrician class, and offers further details:

What played out over the decades in this roughly century-and-a-half period known as the Late Republic was this continuing process of upward transfer of wealth, of regressive taxation, and deficit spending. Perhaps the main source of conflict is the ager publicus: the lands set aside for public farming. The tenants paid a ground rent to the city if they wanted the use of the land, and this allowed a possible class of plebeian smallholders who were self-sufficient enough to farm their own lands, and this class would eventually form the agricultural and military backbone of the Roman society as they made up the majority of the legions [and] produced the majority of the food. The landless proletarians were mostly not even qualified to serve in the legions, since one had to afford a certain amount of equipment in order to fight it all. The plebeian smallholder therefore represented historically something like a middle class. But as always happens when a disintegrative cycle begins to pick up steam […] the upper class squeezes the middle and makes their position precarious and begins to hollow out the center. And what we see in the figures who arise to challenge the trends that are dominating the social order […] is that land is always their main sticking point.

Kjeldsen goes on to tell us (at ~44:06–1:07:11) about various reformers, including the Gracchi brothers and Gaius Marius (of the aforementioned Populares), who attempted to address these issues, but were met with violent opposition from the nobility. But through military achievements and political maneuvering, Caesar was able to seize power and implement reforms, including land redistribution, debt relief, and the expansion of citizenship. However, his reforms threatened the interests of the ruling elite, leading to his eventual assassination by a group of conspirators from the aristocracy, who saw his reforms aimed to address the injustices and exploitation perpetrated by the oligarchy as a threat to their power and way of life. Whether due to visionary reforms or the treachery of his assassination, Caesar became an epoch-making figure who irrevocably transformed the Roman social order and broke the power of the oligarchy, paving the way for a new political order after his death.

For those interested in a further analysis of Parenti’s The Assassination of Julius Caesar, we recommend turning to Eddie Liger of Midwestern Marx, who covered the book himself two years ago. Here, Liger highlights (at ~8:02–24:35) Parenti’s critique of writers like Cicero—who were slave owners and portrayed slavery in a positive light—and draws parallels between slavery in Ancient Rome and the American South, noting the use of racism, torture, and exploitation in both systems. He also compares the role of wage-labor in these societies, with capitalists hiring wage-laborers for riskier jobs to avoid risking their slaves, who were considered property.

(For extra credit, compare and contrast Liger’s analysis here with Kjeldsen’s discussion [at ~39:46–41:27 in the episode discussed above] of slave rebellions in Ancient Rome. Note however that such comparisons aren’t guaranteed to be fruitful, which is why I don’t pursue them here.)

Of course, Parenti isn’t the only Marxist to explore the economy of Ancient Rome. Michael Hudson’s “Property and Debt in Ancient Rome”—published earlier this year through the same Midwestern Marx Institute to which the aforementioned Liger belongs—explores how Roman law and property concepts enabled significant land concentration and socio-economic inequality. Unlike traditional societies that safeguarded family land from being sold off, Roman law emphasized private property’s marketability, facilitating inevitable foreclosures. This creditor-oriented approach favored the wealthy and aggressive families, leading to predatory practices. After Ancient Rome’s foreign conquests, the ager publicus often ended up with the wealthy instead of war veterans or the needy.

Early redistribution attempts, like Consul Spurius Cassius’s proposal in 486 BC, faced fierce patrician resistance and resulted in his execution. Large estates (latifundia), cultivated by slaves after Carthage’s defeat in 204 BC, displaced free farmers, creating an indebted, landless peasantry. Hudson refers also to the attempts of the aforementioned Gracchi brothers to address land inequality, describing their reforms led to their deaths and highlighted rising tensions over land and debt, contributing to prolonged civil unrest. The dispossession of free farmers changed the Roman army’s loyalty from the state to their generals, exploited by leaders like Sulla and Caesar for political power.

Wealth concentration intensified under the Empire, with heavy tax burdens on the poor pushing many to seek protection from wealthy patrons. As Hudson tells us, this would set the stage for the class dynamics of Middle Ages Europe, during which the Church—gaining land through donations—critiqued personal wealth while supporting the status quo, focusing on charity over systemic economic reforms.

On the whole, Hudson’s analysis here underscores how Roman property laws and practices contributed to social stratification and economic disparities, setting a precedent for later European landholding and debt systems. But in fact, Hudson would surely trace that precedent even further than Ancient Rome, as the economist explains in an interview with logician Robinson Erhardt last March.

First, Hudson underscores (at ~2:58–13:25) the inseparable relationship between economics and agriculture with an account of his introduction to the concept of the “autumnal drain”: the need for banks to provide credit to wholesale buyers of crops after the harvest. This led Hudson to realize the cyclical nature of debt crises, with debt burdens growing until the system crashes and debts are wiped out through bankruptcy. Accordingly, he traces the historical rhythm of debt and economic crashes to ancient Mesopotamia, where debts were settled on the threshing floor after the harvest.

In Hudson’s account of economic history (at ~15:15–31:24), debt began with early civilizations like those in the ancient Near East, where rulers recognized the need for periodic debt cancellations due to natural disasters and economic collapses. For example, Hammurabi’s laws included provisions for debt forgiveness during droughts or floods. Ancient practices such as interest charges, weights and measures, and account-keeping originated in this region, yet modern histories often overlook this, focusing instead on Greece and Rome. Regular debt cancellations were a norm, as new kings would erase personal agrarian debts, ensuring economic stability. This practice persisted from Sumer around 2500 BC through various empires until about 1200 BC. Later, in Ancient Greece, debt and land crises led to significant social upheavals and reforms, such as Solon’s debt relief in Athens—though, unlike in earlier practices, he didn’t redistribute land, causing further discontent. This may account for the fact that, as Hudson notes, wealth addiction and the need for special rulers free from such vices were central themes in ancient Greek philosophy, highlighting the dangers of unchecked creditor power and economic inequality.

The rest of Hudson’s interview offers a wealth of information for anyone who would like to learn more about the role of the Catholic Church in promoting debt and interest (at ~45:10–55:57), as well as the parasitic nature of the finance, insurance, and real estate (FIRE) sector (at ~56:49–1:07:10), the influence of the donor class on policymaking in the United States (at ~1:07:39–1:09:44), and the advocacy of classical economists like Adam Smith and John Stuart Mill for taxing economic rent and limiting the power of rentier classes like landlords and bankers (at ~1:21:53–1:25:40).

But to stay on the subject of what connections to present-day economic relationships that contemporary Marxists trace to Ancient Rome, we can turn instead to our trusted Caleb Maupin of the Center for Political Innovation, who offered a useful analysis this past May.

Here, Maupin discusses (at ~39:57–49:25) the historical origins and implications of liberalism, which he locates in Ancient Rome. In his analysis, Western imperialism—emerging from the British thalassocracy, or “empire of the sea”—developed its characteristic philosophy of economic liberalism from Ancient Rome, where its republican system, with an elected national assembly and a hereditary Senate, emphasized individual property rights in the interest of motivating its citizens to participate in expanding its imperial holdings and dividing the spoils. Touching as well on the emergence of populist figures like the Gracchi brothers and the later Caesar, he describes how the internal contradictions of Ancient Rome led to the collapse of the Republic and the establishment of an imperial system with a single emperor, under whom that economic proto-liberalism continued—leading ultimately to the fragmentation of Roman society when the lack of a unified vision made it increasingly difficult to hold the empire together, until such time as the Empire became in its final years unable to even raise an army to defend itself against barbarian invasions.

Tracing liberalism’s ancestry to Ancient Rome gives Maupin the opportunity to draw parallels between the empire’s collapse and the current state of Western capitalist countries like Great Britain and the U.S., which he observes deteriorating from within due to the divergent visions and interests of the ruling billionaire elites, with no central guiding vision for the countries or their populations. In this sense, we might say that Hudson’s analysis of Ancient Rome above emphasizes the material immiseration that its imperial economic system—and descendants thereof—impose upon the working class, while Maupin emphasizes here the ideological poverty that such have cultivated among the same.

So! Those men we talked about at the top, whom the ongoing collapse of the U.S. empire and the collective West has driven to think obsessively about Ancient Rome: what should they learn from all this?

In our own analysis, it seems that Caesar’s assassination and Ancient Rome’s subsequent transition from the Republic to the Empire represented a pivotal turning point in its history as a civilization-state, fundamentally altering its political, social, and economic structures. The Republic’s system of oligarchy with the trappings of senatorial governance gradually gave way to the centralized autocracy of the Empire, marked by the consolidation of power in the hands of a single ruler and ushering in a new era of political stability and territorial conquests, extending Rome’s influence and solidified its status as a dominant power in the ancient world. Thus, the transformation from Republic to Empire not only marked a significant reorganization of Roman governance but also set the stage for its enduring legacy and the complexities that would define its history.

But as we mentioned at the top, our analysis here matches the contemporary American zeitgeist. As if to demonstrate that thinking about the Roman Empire is more than just a trend of yesteryear, Jeremy Ryan Slate appeared on The Kim Iversen Show earlier this month to discuss comparisons between Ancient Rome and the modern USA.

Here, Slate provides an overview of the three eras of Ancient Rome (the Kingdom, the Republic, and the Empire), and tells us (at ~8:42) how the Republic was influenced by struggles between the rich and poor classes, leading to the creation of written laws, the Twelve Tables, in the 400s BC, before the Punic Wars in the 200s BC led to increased militarization, which changed Roman society. Their discussion then turns (at ~14:01) to the Republic’s transition into the Empire, where Slate draws parallels between this period and the current state of the United States, suggesting that the U.S. may be heading towards an oligarchy or empire-like system—in contrast to those above, for whom the Republic already represented an oligarchy.

(Slate would also seemingly disagree in particular with Hoffmeister’s comparison between Trump and Caesar, saying [at ~15:41], “No matter what you want to say, Caesar never relinquished power, whereas Trump may have claimed he won for a bit, but he was he was out of office for the last three years.”)

After noting similarities and differences between the U.S. and the Roman Republic, Slate argues (at ~16:07) that the U.S. has already moved away from a true republic through changes like the 17th Amendment—which changed the election of senators by replacing the phrase “chosen by the Legislature thereof” with “elected by the people thereof”—the income tax, and the Federal Reserve Act, suggesting to him that the U.S. functions more like a democracy headed towards an oligarchy. (As advocates for nationalizing the Federal Reserve, we here would definitely agree that private central banking is symptomatic of oligarchies.)

Of course, those of us thinking along the same lines as Slate, who find ourselves expecting (either unconsciously or with full awareness) such a transition in the U.S. today, would do well to ensure that what emerges afterward—what we’ve been calling “the United People’s Commonwealths of America”—operates more benevolently. With that in mind, it looks like Caesar’s efforts to address the material immiseration of the masses through debt relief should provide some useful inspiration for those interested in how to rebound from the current collapse. Similarly, since we can’t advocate that the next phase of the American civilization-state should go conquer any more territory, it would do us well to consider potential plans for countering the concentration of land and housing in the portfolios of the ruling class.

Fortunately for us, some have already put in much of the work to sketch those plans out. In fact, one comrade of Radio Free Pizza offered some thoughts in January during an interview that we also featured in March: appearing on Deep Dives with Monica Perez, the estimable Daniel Natal expands on those Mesopotamian debt cancellations, which Hudson noted above, while deploying (at ~1:16:26–1:18:39) Frederick Soddy’s Wealth, Virtual Wealth and Debt (1929) and Kristen Ragusin’s The End of Scarcity: The Dawn of the New Abundant World (2022) to connect our modern fiat currencies to the introduction of debt markets to Ancient Rome:

[Soddy] was talking about what a pseudoscience economics was […] because wealth is perishable is subject to laws of entropy, but debt is not. And he was like, […] “You can’t have this mismatch system where debt can accrue forever, you know, past like the moons of Saturn, and wealth […] rots, that goes away, you know, the silo of wheat rots.” So initially in the Middle East, they would have jubilees where the debt would time out as well, right? Otherwise, the system would collapse […] Basically, Semitic peoples came into the [Roman] Empire, and they brought the concept of selling debt, and it was new to the Romans […] so [the Romans] took one half for their system. But they didn’t take the debt jubilee that would have made it actually workable […] [Today,] we don’t have money, we have anti-money, and [Ragusin] was like saying, “Okay, every one of the dollars that you’re holding up is a unit of debt […] if your dollars come into existence when someone takes a loan, or when the treasury prints up bonds, then it's actually a unit of debt, it's anti-money.” And she said that the system collapsed in 2008 because […] if it runs out of people to take new debt, then there's a deflationary crisis […] if we paid off all our debt, there'd be no money in circulation” […] [That] continuous streams of debt […] is why we have things like mass migration. Because if your populace is tapped out and broke, you suddenly need a billion new people: the system requires it.

Because the Romans didn’t incorporate into its debt markets the jubilee that the Torah mandates in the Book of Leviticus—under which all debts were forgiven and all (Israelite) slaves freed every fifty years—their economy contained no mechanism to reset social and economic inequalities. Accordingly, wealth and power remained concentrated within the Roman oligarchy.

Natal’s implied solution here would be to reintroduce a monetary system with a currency backed by something other than debt. (“Like labor *cough* I mean gold?”) Given how those in the U.S. can observe the same phenomenon today—those same Americans who have in 2024 become the most indebted they’ve ever been—it’s clear that examining the parallels between Ancient Rome and modern societies can help us reveal the cyclical nature of economic history, particularly in terms of wealth inequality, debt crises, and the struggle for political reform.

Naturally, Natal’s point here dovetails nicely with what Hudson emphasizes in his interview with Erhardt above about the importance of understanding financial history and the cyclical nature of debt crises to address contemporary economic issues. Given the history of debt cancellations in ancient societies, it may therefore serve us well today to prioritize debt relief, economic stability, and the well-being of the broader population over the interests of creditor classes and rentier elites—perhaps by taxing economic rent and limiting the powers of landlords and bankers, as Hudson tells us classical economists like Adam Smith and John Stuart Mill proposed. As advocates of a socialism with American characteristics, we’re also quite enthusiastic here about Hudson’s idea of treating land, banking, and housing as public utilities, rather than sources of private profit and rent extraction.

On a similar note, Armstrong’s “Anatomy of a Debt Crisis” (2012) discusses the historical context and implications of debt crises throughout history, emphasizing the recurring nature of economic mistakes and the ignorance of leaders who fail to learn from the past. Here he criticizes the then-current practice of bailing out banks, suggesting that this contributed to economic instability and inequality, and proposes capping interest rates, reducing debt burdens, and implementing indirect taxation. Armstrong returned to Caesar three years later, writing in 2015 about how Caesar’s approach acknowledged the fluctuating value of money throughout history, challenging misconceptions about currency stability. He adds here that Emperor Tiberius employed a similar strategy during the 33 AD debt crisis—suspending interest payments and increasing the money supply to combat deflation—but notes sadly that, despite these historical precedents, modern responses to financial crises often overlook these solutions, repeating mistakes and ignoring lessons from history.

For Armstrong, Caesar’s economic reforms reveal his vision for a more just and prosperous society, prioritizing the state’s welfare over personal power, in contrast to oligarchic opponents who resisted change to maintain their dominance. Drawing parallels to modern economic policies, he advocates for reforms similar to Caesar’s approach, and suggests parallels between the corruption of the Roman Republic and contemporary societal challenges.

As one might expect of a paleoconservative economist, however, Armstrong offers his own proposal contrasting Natal’s implied solution of introducing the jubilee into Western debt markets, as he pitched (at ~38:07–39:20) to The Duran earlier this month:

I have a solution, I’ve argued it, but the problem is [the political elite] lose power so they don’t want to take it. And if I was to straighten it out, I would deal with the same way I have had to deal […] with multinational companies: you do a debt-to-equity swap […] So what you do is you take the debt that’s there. You basically say, “Okay, fine. We’ll give you a coupon. [If] you’ve got a 30-year bond. You go back, you get a coupon for it […] and then you can buy corporate bonds, or corporate shares or whatever” […] Alright: you’re monetizing the debt. Yes, alright. But [make a rule that this] money can only be used domestically, and it would create jobs, and it’s the only way out. But instead what these people are doing is they want to default, wipe out all the pension funds and everything else [and] go to war.

Still, one can easily imagine that the jubilee discussed above could go hand-in-hand with Armstrong’s debt-to-equity swap. Pretty simply, in fact: private citizens have their debts cancelled, while those holding public debt receive the swap. Easy enough! (Add from Slate the implied abolition of the income tax and of the Federal Reserve, and it looks like Libertarian Communism might just have itself the foundations for an economic policy platform!)

But I suppose it might be a stretch to assume that Armstrong would agree too much if Parenti, Liger, Hudson, or Maupin cast Caesar as in any way carrying on the legacy of reformers like the Gracchi brothers, who sought the outright redistribution of land. (He might find himself nodding along with Slate about how the 17th Amendment and federal income tax promote oligarchic tendencies, though I question whether he’d also point to the Federal Reserve Act—after all, he defends the central bankers because “their self-interest is against that of the politicians.”) Indeed, one can imagine easily that he’d disagree with Maupin in depicting the economic ideology of Ancient Rome as a progenitor of liberalism—let alone with the idea that the self-serving oligarchs who opposed Caesar were merely operating according to the same economic proto-liberalism that Maupin finds responsible for ultimately fragmenting Roman society—and, therefore (it’s clear to us), for Ancient Rome’s failure to endure as a civilization-state.

Nonetheless, we can much more easily imagine Armstrong agreeing with Maupin about the divergent interests of today’s ruling elites and the lack of a unifying vision is causing the economic collapse of the capitalist republics of the collective West. (Not quite as easily as we can imagine Hudson agreeing—but it’s start!) Moreover, it’s hard to imagine any of the aforementioned commentators would disagree with Caesar’s lasting legacy and impact—despite his assassins’ opposition (as ancient forebears of Hudson’s rentier class) to his reforms as a threat to their power and way of life—in breaking the power of Ancient Rome’s oligarchy and paving the way for a new political order.

Surely Maupin and Hudson would agree with each other in acknowledging the necessity of critically examining the role of the financial sector in shaping economic policies to favor activities that do not contribute to real production. We imagine, too, that the countries of today can meet this necessity while also satisfying the requirement that Armstrong identifies for fair and balanced debt management, and for the need for systemic reforms to stabilize the economy and promote growth. These, of course, are just some ideas to address the disintegrative trends of wealth accumulation among the ruling class and the immiseration of the working class.

As we navigate our own era’s challenges, the lessons from Ancient Rome serve as both a warning and a guide: they remind us of the potential for both monumental achievements and catastrophic failures when power dynamics and economic interests are at play. It makes sense, then, that this historic civilization should fascinate anyone today—but particularly as a lens through which we examine contemporary social and political dynamics. The rich tapestry of Rome’s political history—from the Republic’s ideals of checks and balances to the Empire’s centralized power—provides a fertile ground for understanding modern governance and societal issues. Accordingly, the recent social media trend highlighting Ancient Rome’s influence underscores a deeper societal search for stability and purpose amidst current uncertainties.

However, by examining figures like Julius Caesar through the lenses of different ideologies, from conservative economic analysis to Marxist critiques, we gain a richer understanding of the multifaceted impact of Ancient Rome’s political and economic systems. From that understanding, we can develop a plan for ferrying the U.S. across its forecasted Rubicon, to ensure that the next stage of America’s progress as a civilization-state reverses the trend of imperialist economic strategy and popular immiseration, instead of descending into base autocracy and capital-E Empire. As it stands, the Libertarian Communist prescription derived from that understanding would include cancelling household debts, enacting an equity swap on sovereign debts—maybe exchanging them for second-class shares in “AmericaNOC”? Ones that have no voting rights and earn no dividends? If it’s possible to issue shares in a state-owned oil company, that is—and nationalizing the U.S. central banking system.

Ultimately, the legacy of Ancient Rome, with its blend of ambition, innovation, and dramatic political shifts, continues to shape our world. Examining that legacy offers valuable insights into the enduring themes of governance, societal structure, and human aspiration. As we at Radio Free Pizza continue to explore these deep trends, we invite our audience to reflect on the echoes of Ancient Rome in today’s political and economic landscape, and to consider how history’s lessons might inform our designs for a better future.